Simplifying India’s GST Puzzle to boost economic growth. India’s Goods and Services Tax (GST) system, introduced to unify the country’s tax landscape, has been a subject of both praise and criticism. One of the pressing concerns is the complexity of its four-tier tax structure, comprising rates of 5%, 12%, 18%, and 28%.

The call for GST rate rationalization grows louder, aiming to streamline the tax system, ease compliance burdens, and offer relief to consumers. Let’s delve into the necessity, challenges, and recent developments surrounding this crucial reform.

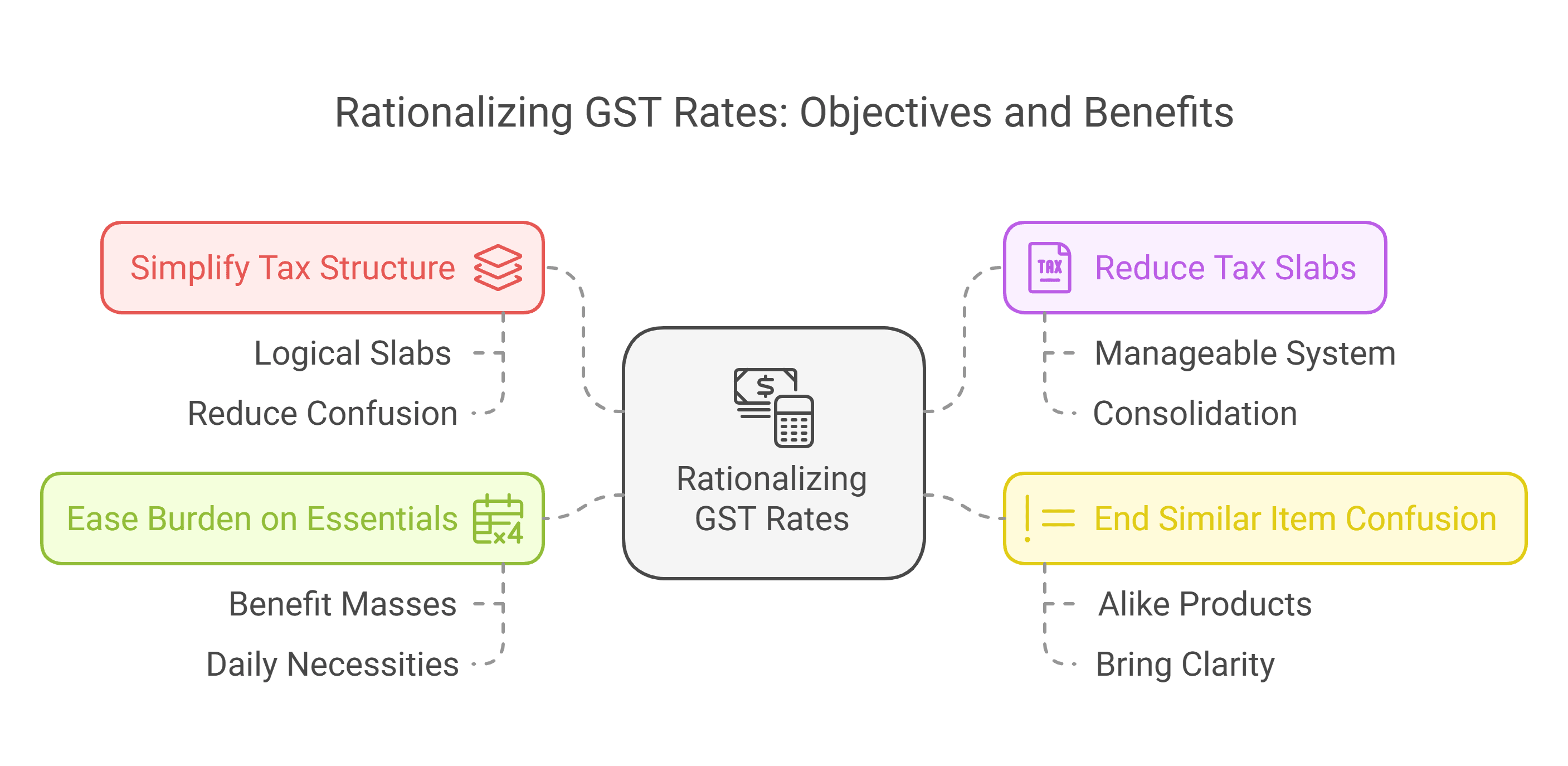

The primary goals of this endeavor are clear:

Despite the obvious need, rationalizing GST rates is no easy feat:

The GST Council has taken a significant step by establishing a Group of Ministers (GoM) to tackle rate rationalization. Key proposals on the table include:

Merging the 12% and 18% tax slabs

These suggestions aim to achieve a more streamlined tax system, reduce bureaucratic burdens, and potentially generate additional revenue. However, the outcome remains uncertain, leaving the rationalization of GST rates a work in progress.

WhatsApp us